VRS website: https://www.varetire.org/

RRS website: https://www.rva.gov/

Your Options During the VRS Transition

If you are a current full-time employee, you have a choice to either stay in RRS or move to VRS. This decision is permanent. You will have until the end of next year – December 31, 2024 – to make your decision.

On and after January 1, 2024, current retirement-eligible employees will be able to enroll in VRS if they choose to move retirement systems. New employees will be automatically enrolled in VRS..

As you navigate your decision either to remain in RRS or transition to VRS, you will want to understand your current RRS plan and what plan you would go into in VRS.

Click below to learn more about your RRS and VRS plan options as a general or Sworn employee. Sworn employees are those who are sworn police or firefighters. General employees are not sworn police officers or firefighters.

If you are currently a part-time employee, you are not eligible for retirement benefits.

If you are a constitutional officer, you already receive retirement from the Virginia Retirement System.

Resources

Under the Code of Virginia § 51.1-800 , every locality must provide a retirement system for its employees, either through a local retirement system or by participating directly in the Virginia Retirement System (VRS).

For many years, the city has provided retirement through its own retirement system: the Richmond Retirement System (RRS). RRS is one of a handful of independent retirements systems in the state.

RRS was established in 1945 and is a component unit of the City of Richmond. The system administers defined benefit and defined contribution retirement plans for more than 10,000 members, and the system has approximately $500.0 million in net assets. RRS is supervised by its Board of Trustees, a seven-member group that oversees the administration of defined benefit and defined contribution retirement plans. Board members are appointed by Richmond City Council and the Mayor in accordance with the Richmond City Charter, and at any time at least two members are city employees.

With the transition to the Virginia Retirement System on January 1, 2024, the City of Richmond will join most localities as a political subdivision in VRS.

VRS was established in 1942 and exists as an independent state agency based in Richmond. It delivers retirement and other benefits to covered Virginia public sector employees. VRS is the 14th largest public or private pension fund in the U.S. and 42nd largest in the world. Its members include public school teachers, political subdivision employees (cities, towns, special authorities, and commissions), state agency employees, public college and university personnel, state police, Virginia law officers and the judiciary. Over 832 employers participate in VRS, including several hundred towns, cities, and counties.

As a general employee, your RRS retirement options depend on when you were hired by the city. Read more about the plans in the RRS Handbook for General Employees.

RRS Defined Benefit Plan (pension plan)

- You are eligible if you were hired before July 1, 2006

- Calculated monthly benefit (length of service * salary * multiplier)

- Required employee contributions:

- Defined Benefit Basic: 1.0%

- Defined Benefit Enhanced: 4.57% (1.0% base + 3.57%)

- Required employer ADC calculated by the system’s actuaries

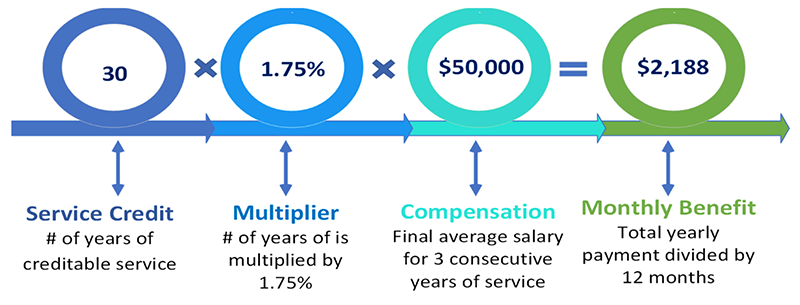

How is the RRS Defined Benefit Plan for general employees calculated? (Illustration only)

If you have an RRS Defined Benefit plan, your benefit is calculated based on:

Creditable years: # years worked + military (while working for COR) + P/T + ported + purchased + severance + 50% unused sick leave balance

Creditable compensation: average highest 3 consecutive years + differential pay + educational + bonuses + severance

Basic vs. Enhanced Plan Options: Required employee contributions of 1.00% (basic) or 1.00% + 3.57% = 4.57% (Enhanced)

RRS Defined Contribution Plan (401(a) Plan)

- You are eligible if you were hired after July 1, 2006

- Account balance is calculated based on contributions and investment returns

- Until December 30, 2023, no required employee contribution

- Until December 30, 2023, required employer contribution based on years of service:

- <5 years = 5.00%

- 5 - 9 years = 6.00%

- 10 -14 years = 8.00%

- 15+ years = 10.00%

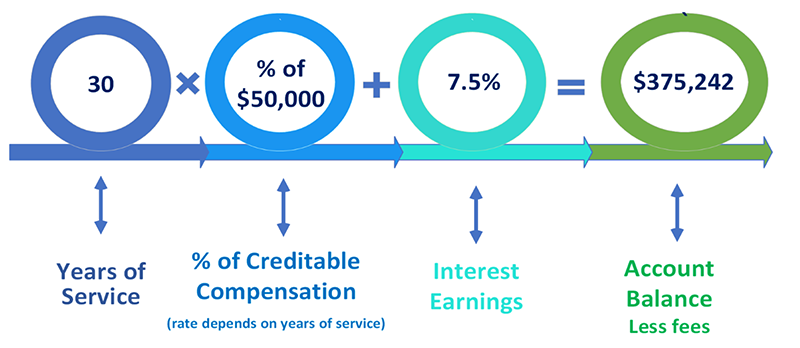

How is the RRS Defined Contribution Plan calculated?

If you have the RRS Defined Contribution Plan, your benefit is calculated based on:

Creditable years: # years worked + military (while working for COR) + severance

Creditable compensation: current pay rate + differential pay + educational + bonuses + severance

| RRS Defined Benefit (DB) | RRS Defined Benefit (DC) | |

|---|---|---|

| What is it? | Pays out a monthly benefit | Account balance based on investment performance |

| How is it funded? |

Employer Contribution (ADC) |

Employer Contribution Only (Percent of salary depending on years of city service) <5 years = 5.0% 5-9 years = 6.0% 10-14 years = 8.0% 15+ years = 10.0% |

| What's the vesting period? | Five Years | Five Years |

As a general employee, your VRS retirement options depend on whether or not you have prior years of service in VRS, in general. There may be exceptions. All employees should verify their options with VRS.

If you do have prior VRS service, you will likely go into the VRS plan you were in previously. However, there may be exceptions. Check with VRS to confirm.

If you do have prior VRS service, you will go into the VRS plan you were in previously.

VRS Plan 1 (pension plan): You are eligible if you were:

- A VRS member before 7/1/2010 &

- Vested by 1/1/2013

VRS Plan 2 (pension plan): You are eligible if you were:

- A VRS member after 7/1/2010 and before 12/31/2013 OR

- A VRS member before 7/1/2010 & not vested by 1/1/2013

VRS Hybrid Plan (has both pension plan and DC plan components): You are eligible if you:

- Have no prior VRS service

- A VRS member after January 1, 2014

You are immediately vested in any funds that you contribute to your VRS plans. However, you must be vested to be eligible to take a distribution of employer contributions.

| Plan 1 | Plan 2 | Hybrid Plan | ||

|---|---|---|---|---|

| What is it? | Defined Benefit | Defined Benefit | Defined Benefit | Defined Contribution |

| Am I eligible? | If I was a prior Plan 1 member | If I was a prior Plan 2 member | If I have no prior VRS service OR if I was a prior Hybrid Plan member | |

| How is it funded? | Employer Contribution (ADC) + Employee Contribution (5% of salary) |

Employer Contribution (ADC) + Employee Contribution (5% of salary) |

Employer Contribution (ADC) + Employee Contribution (4% of salary) |

401(a) Mandatory: 457 Voluntary: |

| How is the benefit calculated? | Compensation Rate Base x Eligible Years of Service x Compensation Rate Multiplier = Monthly Benefit |

Compensation Rate Base x Eligible Years of Service x Compensation Rate Multiplier = Monthly Benefit |

Compensation Rate Base x Eligible Years of Service x Compensation Rate Multiplier = Monthly Benefit |

Based on withdrawal choices |

| What is the vesting period for Employer Contributions? | Five Years | Five Years | Five Years |

Two years = 50% |

About the VRS Hybrid Plan

The Hybrid Plan includes both Defined Benefit (pension) and Defined Contribution (investment account) components.

The DC component allows for voluntary employee contributions of up to 4% that the employer will match up to 2.5%. Please see the table below for potential contributions to the VRS Hybrid Plan.

| Plan Component | Employee | Employer | Total Possible Contribution |

|---|---|---|---|

| DB | 4.0% | ADC | 4.0% + ADC |

| Mandatory DC | 1.0% | 1.0% | 2.0% |

| Voluntary DC | +Up to 4.0% | +Up to 2.5% | + Up to 6.5% |

| Total Possible | 9.0% | ADC + 3.5% | AD + Up to 12.5% |

General Employee Comparison of RRS and VRS Plans

As a Sworn police officer or firefighter, you have a choice between the RRS Defined Benefit or Defined Contribution plan. Read more about the plans in the RRS Handbook for Sworn Police Officers and Firefighters.

- RRS Defined Benefit Plan (pension plan)

- You are eligible upon hire

- Calculated monthly benefit (length of service * salary * multiplier)

- Required employee contributions:

- Defined Benefit Basic: 1.5%

- Defined Benefit Enhanced: 5.45% (1.5% base + 3.95%)

- Required employer ADC calculated by the system’s actuaries

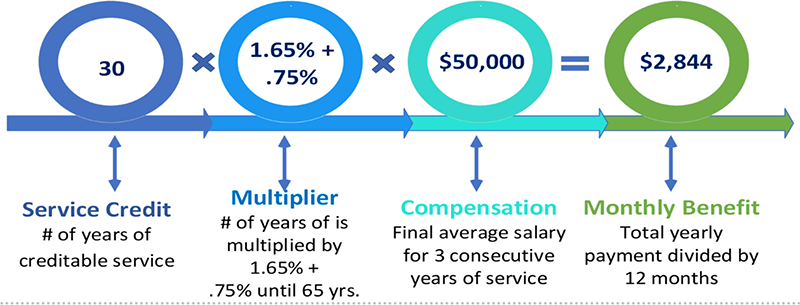

- How is the RRS Defined Benefit Plan for Sworn employees calculated? (Illustration only)

If you have an RRS Defined Benefit plan, your benefit is calculated based on:

- Creditable years: # years worked + military (while working for COR) + P/T + ported + purchased + severance + 50% unused sick leave balance

- Creditable compensation: average highest 3 consecutive years + differential pay + educational + bonuses + severance

- Basic vs. Enhanced Plan Options: Required employee contributions of 1.50% (basic) or 1.50% + 3.95% = 5.45% (Enhanced)

RRS Defined Contribution Plan (401(a) Plan)

- You are eligible if you were hired after July 1, 2006

- Account balance is calculated based on contributions and investment returns

- Until December 30, 2023, no required employee contribution

- Until December 30, 2023, required employer contribution based on years of service:

- <5 years = 5.00%

- 5 - 9 years = 6.00%

- 10 -14 years = 8.00%

- 15+ years = 10.00%

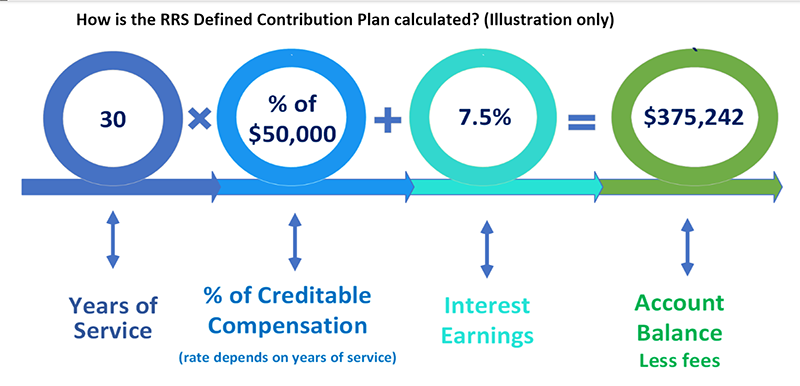

How is the RRS Defined Contribution Plan calculated? (Illustration only)

If you have the RRS Defined Contribution Plan, your benefit is calculated based on:

- Creditable years: # years worked + military (while working for COR) + severance

- Creditable compensation: current pay rate + differential pay + educational + bonuses + severance

| RRS Defined Benefit (DB) | RRS Defined Contribution (DC) | |

|---|---|---|

| What is it? | Pays out a monthly benefit | Account balance based on investment performance |

| How is it funded? | Employer Contribution (ADC) + Employee Contribution (Percent of Salary - 1.5% Base) |

Employer Contribution Only |

| What is the vesting period? | Five Years | Five Years |

As a Sworn police officer or firefighter, your VRS retirement options depend on whether or not you have prior years of service in VRS.

If you do not have prior VRS service, you will go into the VRS Plan 2 for Hazardous Duty employees.

If you do have prior VRS service as a Sworn employee, you will go into the VRS Hazardous Duty plan you were in previously.

VRS Plan 1 for Hazardous Duty employees (pension plan): You are eligible if you were:

- A VRS member before 7/1/2010 &

- Vested by 1/1/2013

VRS Plan 2 for Hazardous Duty employees (pension plan): You are eligible if you were:

- A VRS member after 7/1/2010 OR

- A VRS member before 7/1/2010 & not vested by 1/1/2013

You are immediately vested in any funds that you contribute to your VRS plans.

You must be vested to be eligible to take a distribution of employer contributions.

Sworn Employee Comparison of RRS and VRS Plans

The city reserves the right to make benefit changes.